April 2023: Investment Insights

Summary

First quarter economic data showed the U.S. economy entered 2023 with considerable momentum

Three regional banks failed in March as the banking industry faced a crisis of confidence

In general, the worst performing sectors in 2022 are the top performing sectors in 2023

Credit markets will be watching for signs of refinancing stress in the coming months

Strong Start With All Eyes On Banks

First quarter economic data showed the U.S. economy entered 2023 with considerable momentum, even in light of the Federal Reserve’s interest rate hikes throughout 2022.

Fourth quarter 2022 GDP data showed the U.S. economy grew at a +2.6% rate. The growth was largely driven by a resilient consumer, inventory restocking, and increased government spending, while businesses cut back their spending and the housing market remained weak.

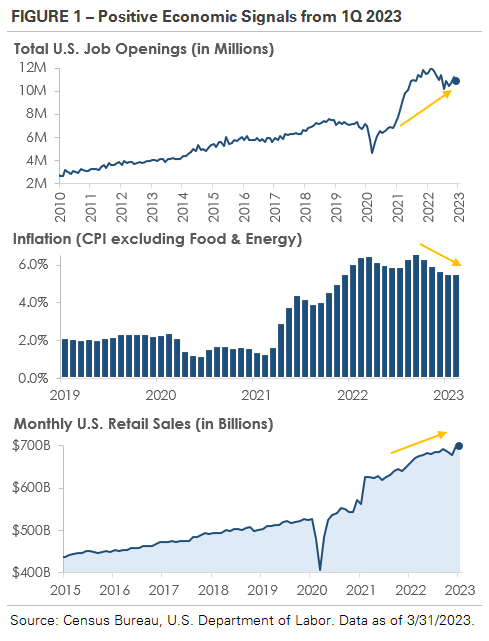

Additional economic data in Figure 1 highlights the broad economic trends. Jobs remain plentiful with job openings significantly above pre-pandemic trend, inflation is easing, and consumer spending remains above trend.

The data shows growth is normalizing as the economy returns to its pre-pandemic trend but suggests the economy is withstanding higher interest rates thus far.

Positive Signs

The economy is withstanding higher interest rates so far. Part of the reason may be the high level of employment and company sales going strong.

Financial markets turned rocky during the last month of the quarter. Three regional banks failed, and the U.S. Treasury bond market became more volatile as investors debated whether the Federal Reserve would continue to raise interest rates against an uncertain backdrop.

Regional Banks Fail After Sudden Withdraw Spree

Three regional banks failed in March as the banking industry faced a crisis of confidence and customers quickly withdrew deposits.

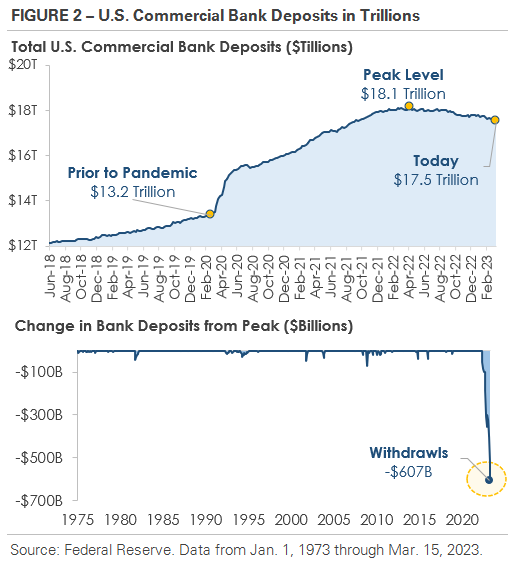

The top chart in Figure 2 shows deposits at U.S. commercial banks rose from $13.2 trillion at the end of 2019 to a peak of $18.1 trillion in April 2022 as businesses and individuals flooded banks with new deposits during the pandemic.

More recently, deposits at commercial banks decreased in 9 of the last 12 months. The bottom chart in Figure 2, which graphs the change in bank deposits from peak levels, shows total U.S. commercial bank deposits have declined -$607 billion since April 2022. The decline marks the biggest banking sector deposit outflow on record and is starting to stress bank balance sheets.

To meet withdrawal requests, banks maintain a portion of their assets as liquid reserves, such as government bonds and commercial paper, that can quickly be converted to cash. If banks exhaust the liquid reserves, they can either borrow from other banks and the Federal Reserve or sell assets, such as their bond holdings.

This basic process helps explain why three banks failed.

Depositors overwhelmed the banks in early March with withdrawal requests. The banks exhausted their liquid reserves, could not obtain loans from other banks or the Federal Reserve in a time-efficient manner, and were forced to sell their most liquid assets, which consisted of U.S. Treasury bonds and mortgage-backed securities.

The problem for the banks is interest rates are significantly higher than when the banks bought the bonds, and the bonds are now worth less. When the banks sold the bonds, they were forced to realize billions of dollars of losses, which drained their capital cushions and made them technically insolvent.

State banking regulators and the FDIC immediately stepped in to take over the failed banks and protect depositors.

Overwhelmed By Withdrawals

Banks were flush with cash from new deposits during the pandemic. When a flood of withdrawal requests came in, some banks had already tied up most of their deposits in long term bonds.

These recent bank failures have raised concerns about financial stability and drawn comparisons to 2008. However, there are important differences from 2008, including both regulatory changes and the causes of insolvency.

Banking reforms after the 2008 crisis strengthened the overall financial system, and higher capital requirements now provide banks with a more robust financial cushion.

In addition, regulators now possess greater authority to resolve issues in large, failed banks in order to avoid chaotic situations like the Lehman Brothers bankruptcy.

In terms of cause, the 2008 crisis was primarily triggered by bad loans and complex securities.

In contrast, recent bank failures resulted from the Federal Reserve’s rapid interest rate increases, which created paper losses for banks that made loans or purchased bonds at lower interest rates.

Speaking of Interest Rates…

The Treasury market is experiencing more volatility and illiquidity because of conflicting signals about the strength of the U.S. economy and the Federal Reserve's policy plans.

Solid economic data in January showed the U.S. economy coping well with rising interest rates, suggesting the Federal Reserve may need to do more than anticipated to ease inflation.

During early March congressional testimony, Federal Reserve Chair Jerome Powell spooked markets by suggesting the central bank would need to raise interest rates higher than initially thought and then keep interest rates higher for longer.

The warning caused Treasury yields to rise and bonds to trade lower. Less than one week after Powell testified, multiple regional banks collapsed, causing worries about the U.S. financial system’s stability.

Treasury yields reversed course and declined, causing bonds to trade higher. The two conflicting themes have resulted in wild price swings in the usually quiet Treasury market as traders place bets on the likelihood of future rate cuts.

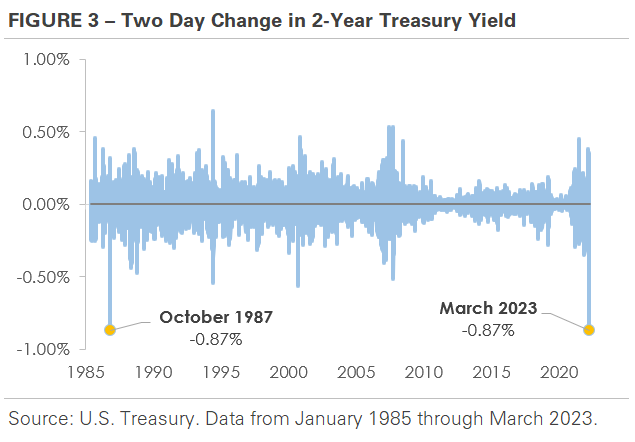

Figure 3, which graphs the rolling 2-day percentage change in the 2-year U.S. Treasury yield, shows the recent spike in volatility.

Taller bars indicate the 2-year Treasury yield experienced a bigger 2-day move. The chart looks like a heartbeat over the past 12 months, going up and down with occasional volatility as markets responded to new information.

However, the far right of the chart shows a spike in both directions recently. The 2-year yield plunged -0.87% on March 13th after two regional banks failed over the weekend, its biggest 2-day decline since the Black Monday stock market crash in October 1987.

After banking regulators took over control of the banks and the Federal Reserve introduced lending programs to stabilize the banking sector, the 2-year yield surged +0.35% on March 21st.

Heartbeat of Interest Rate Yields

The taller the bar, the bigger the move in yields. Volatility has picked up with the swiftness of news headlines.

What is causing the volatility? Investors now fear the Federal Reserve faces a tough set of choices.

The central bank must balance bringing inflation under control with minimizing damage to the U.S. economy.

One factor complicating the central bank’s task and contributing to interest rate volatility is the lagged effect of monetary policy – it is difficult to model how 2022’s interest rate hikes already have and will impact the economy.

As a result, there is little consensus inside the Federal Reserve on the path of monetary policy. The central bank’s Summary of Economic Projections, which provides forecasts for key economic indicators and offers insights into the future direction of monetary policy, shows a wide range of interest rate projections.

Projections for interest rates at the end of 2024 range from 3.4% to 5.6%, while the 2025 projection range is 2.4% to 5.6%. With even the Federal Reserve uncertain about policy, interest rates could remain volatile in the coming quarters.

How does the volatility impact businesses, consumers, and investors?

Treasury securities are considered safe-haven assets, used as collateral for loans and other debts, and serve as a benchmark for pricing other financial securities, such as corporate and municipal bonds, mortgages and other asset-backed securities, and money market instruments.

Increased volatility and illiquidity can disrupt the flow of credit, making it more challenging to price loans and various other financial products.

While current volatility is linked to uncertainty about Federal Reserve policy rather than financial system stress, the risk is interest rate volatility spreads to other corners of financial markets.

For businesses and consumers, this could mean higher financing costs and more difficulty obtaining loans. For investors, this could mean borrowers are unable to refinance their maturing bonds and end up defaulting on their principal and interest payments.

Stock Trends During the 1st Quarter

Stocks traded higher in January before giving up some of their gains in February and March. The S&P 500 Index of large cap stocks ended the first quarter up +7.4%, outperforming the Russell 2000 Index’s +2.7% return.

Most of the S&P 500’s relative outperformance occurred in March as investors de-risked their portfolios following the bank failures.

There was also a sizable shift in factor performance during the first quarter. The Russell 1000 Growth Index gained +14.3%, outperforming Russell 1000 Value’s +0.9% return.

Like the S&P 500, the Growth factor’s relative outperformance occurred in March after the bank failures. Growth stocks tend to be higher quality businesses with stronger fundamentals, and recent bank failures may have motivated investors to rotate into higher quality companies.

Regardless of the cause, Growth’s outperformance is a significant change from 2022 when the Federal Reserve’s interest rate increases weighed on expensive stock valuations.

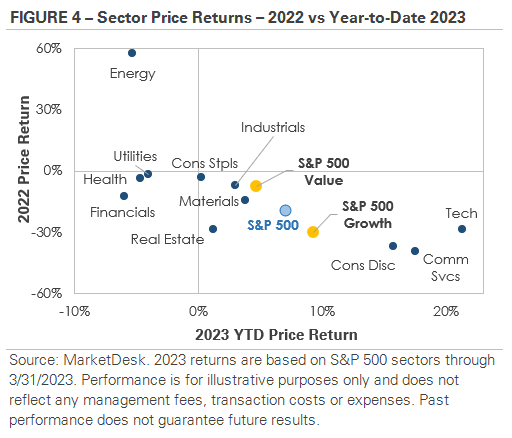

The Growth vs Value performance reversal also shows up in first quarter sector returns, with Growth-style sectors outperforming. Figure 4 is a scatterplot that compares each sector’s 2022 return (vertical y-axis) against its first quarter 2023 return (horizontal x-axis).

In general, the worst performing sectors in 2022 are the top performing sectors in 2023, while 2022’s top performing sectors are broadly underperforming to start 2023. Beyond the year-to-date performance reversal, there was no obvious preference for defensive or cyclical sectors.

Yesterdays Losers Are Todays Winners

The worse performers of 2022 are now the best performers of 2023.

Turning to global markets, international stocks posted positive returns during the first quarter.

The MSCI EAFE Index of developed market stocks gained +9.0%, outperforming the MSCI Emerging Market Index’s +4.1% return.

Europe was the top performing international region and boosted developed markets’ performance. The region managed to avoid a major energy crisis during the winter months thanks to unseasonably warm weather and efforts to secure alternative natural gas sources after Russia cut off most of its supply. Short-term gas prices have fallen from record highs, preventing severe shortages and rationing, although utility bills remain high.

In Asia, all eyes remain on China as the country reopens after relaxing its Covid-zero restrictions. The reopening is expected to boost China’s economy, and potentially the global economy, but it is unclear how strong or lasting the growth will be.

Bond Trends During the 1st Quarter

Bonds traded in both directions during the first quarter, initially trading higher in anticipation of the end of the tightening cycle before trading back lower as the Federal Reserve hinted at higher interest rates for longer.

Corporate investment grade bonds ended the first quarter with a +4.6% total return, outperforming corporate high yield’s +3.7% total return. Like equities, investment grade’s outperformance primarily occurred in March after bank failures raised concerns of increased default risk.

Tighter bank lending standards are becoming a concern in credit markets. For perspective, banks aggressively tightened lending standards during the last 12 months in anticipation of the Federal Reserve’s interest rate hikes slowing economic growth.

With recent bank failures causing banks to question the stability of checking deposits, there is a risk that banks will adopt a more cautious approach to lending and reduce the total amount of credit they offer.

The decreased credit supply and access to credit could have a domino effect, impacting the economy and financial markets over time. Borrowers, specifically high-yield issuers, could default on their debt if it becomes difficult and too expensive to refinance their maturing loans.

Credit markets will be watching for signs of refinancing stress in the coming months.

Cloudy Outlook Going Forward

Our outlook is indecisive as financial markets close out the first quarter of 2023.

Some investors believe the Federal Reserve’s actions will slow economic growth and tip the U.S. economy into a recession. This group points to recent bank failures as a warning sign that higher interest rates will have a negative impact.

In contrast, some investors believe the U.S. economy is strong enough to withstand the Fed’s actions. This group points to first quarter economic data as a sign of strength and banking regulators’ actions as an indication the U.S. financial system is functioning as intended.

The back and forth is likely to continue until some of the market’s most pressing questions are answered.

Key questions include the direction of Federal Reserve policy, the stability of the U.S. banking sector, inflation’s stickiness, corporate earnings growth, and the strength of the U.S. economy.

We will be monitoring the answers to these questions in coming months to help guide investment portfolio positioning, with first quarter earnings season scheduled to start in mid-April.

As we have mentioned previously, the current investing environment requires a long-term outlook. Trend changes are frequent, fast, and driven by fluctuating market headlines, and keeping up with the day-to-day whims of the market can be emotionally taxing. Developing a financial plan and sticking to it are important steps to achieving your financial goals