January 2024: Investment Insights

Summary

Treasury yields reverse lower in fourth quarter

With inflation falling, markets expect rate cuts

US economy defied expectations in 2023

Can the US economy continue to live up to the optimism?

Treasury yields Reverse Lower in Fourth Quarter

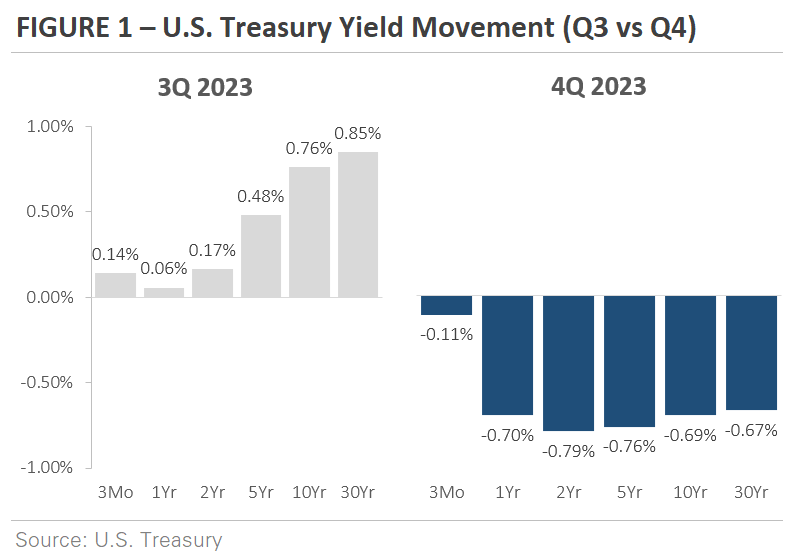

Following a significant increase in Q3, Treasury yields moved sharply lower in Q4. Figure 1, which compares the change in yields during the two quarters, graphs the opposing interest rate moves.

The gray bars show yields increased in Q3, with longer maturity yields rising the most. In contrast, the navy bars show yields reversed sharply in Q4, erasing nearly all their Q3 rise.

The abrupt reversal can be attributed to a significant change in the market’s view heading into 2024.

Q3 vs. Q4 Treasury Yields

The abrupt reversal in rates demonstrate the markets view of lower rates in 2024.

Investors had two key concerns, both of which contributed to the rise in Treasury yields during Q3.

First, the U.S. economy continued to outperform expectations, which raised concerns that the Federal Reserve might need to keep interest rates high for an extended period to cool inflation.

Second, the fiscal deficit was growing quickly as government spending increased.

Investors were concerned the U.S. Treasury would need to issue a large amount of new debt to finance the growing deficit but that there wouldn’t be enough buyers for the new bonds, potentially causing yields to rise if supply outweighed demand.

A notable shift occurred in November, setting off a sharp reversal in Treasury yields. Investor worries about increased Treasury bond issuance were alleviated as the U.S. Treasury revealed plans to slowly increase bond issuance.

The market felt there would be enough demand to absorb the new bonds, lowering the probability that too much bond supply would cause yields to rise.

In addition, data showed that inflation continued to decline even as the economy continued to exceed expectations.

Investors’ fears about persistent inflation and high interest rates faded from view, and yields declined.

With Inflation Falling, Market Expects Rate Cuts

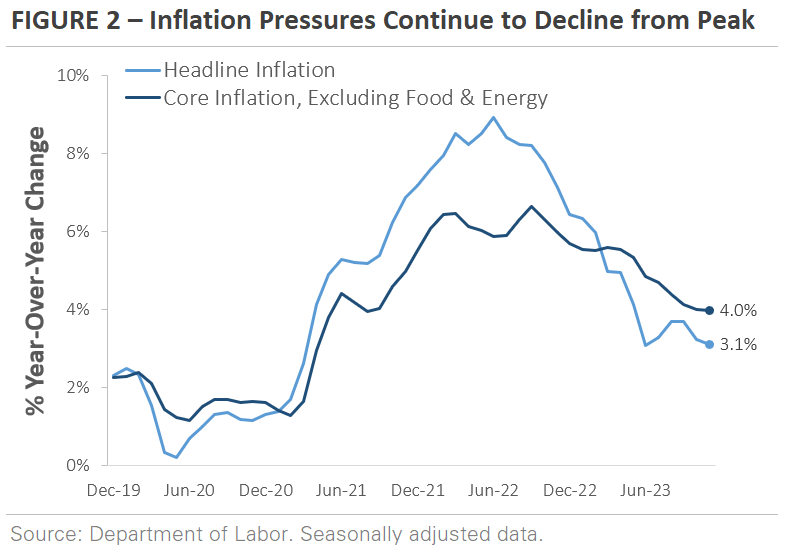

Data shows that inflation pressures continue to ease. Figure 2 graphs the year-over-year change in headline and core inflation.

Headline inflation, which peaked at 9.1% in June 2022, dropped to 3.1% in November 2023.

Likewise, core inflation, which excludes the volatile categories of food and energy, now stands at 4.0% after peaking at 6.6% in September 2022.

The price declines have been widespread across categories, with price pressures easing across food, energy, airfares, and household furnishings and appliances.

Falling Inflation

Investor optimism is on the rise as pricing pressures ease.

Investor optimism is on the rise as price pressures ease, with inflation forecasted to remain low and stable in 2024.

Likewise, the Federal Reserve is hinting at interest rate cuts if inflation continues to fall. Investors are more confident that the Fed will cut interest rates in early 2024, with no clear need to keep interest rates at current levels as inflation falls back toward 2%.

Looking ahead to 2024, futures markets currently forecast six interest rate cuts, with the first cut as early as March.

It’s a big change from Q3, when there was concern that the Federal Reserve would need to keep raising interest rates.

One of the key themes to watch in 2024 will be how much the Federal Reserve cuts rates.

US Economy Defied Expectations in 2023

The question heading into 2023 was whether the economy could withstand the effects of higher interest rates.

The Federal Reserve aimed to cool inflation by raising interest rates and reducing demand, and the central bank appeared to be well on its way toward accomplishing its goal.

The cost of capital was rapidly increasing. The housing market and home construction activity were slowing. Shipping rates were falling as freight demand declined and supply chains normalized.

While portions of the economy slowed in 2023, the broader economy displayed remarkable resilience, even as the Federal Reserve continued to raise interest rates.

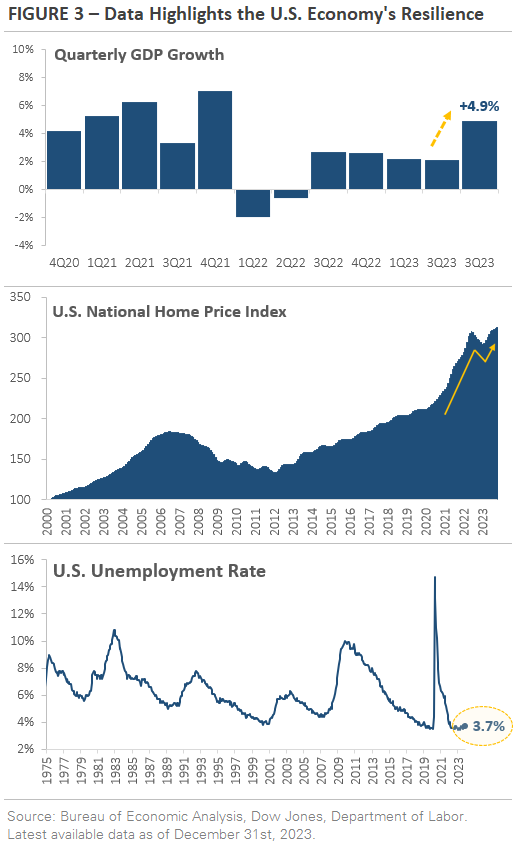

Figure 3 graphs three data points that underscore this resilience. The top chart shows the U.S. economy grew at a +4.9% annualized pace in Q3, the fastest pace since Q4 2021.

Multiple factors contributed to the above-average growth, including consumer spending, government investment at the federal and state levels, and companies restocking inventories.

The middle section shows the surge in U.S. home prices during the pandemic, as factors like remote work, low mortgage rates, and rising wages boosted home demand. The home price index initially peaked in mid-2022 and declined over the next 10 months as rising mortgage rates weighed on demand.

However, home prices rose to a new record high as the housing market reaccelerated in the second half of 2023.

The bottom chart shows the U.S. unemployment rate remains below 4%, a level that is low by historical standards and showcases the labor market’s strength.

While these three data points are lagging and reflect past performance, they underscore the economy's resilience. They also indicate that higher interest rates aren’t having the impact that many thought they would.

With inflation falling and the economy growing, investors are starting to believe that the Fed can achieve its goal of lowering inflation without negatively impacting the economy.

US Economy’s Resilience

GDP Growth, Home Prices, and the Unemployment Rate have not been negatively affected by higher rates.

Stock Trends During the 4th Quarter

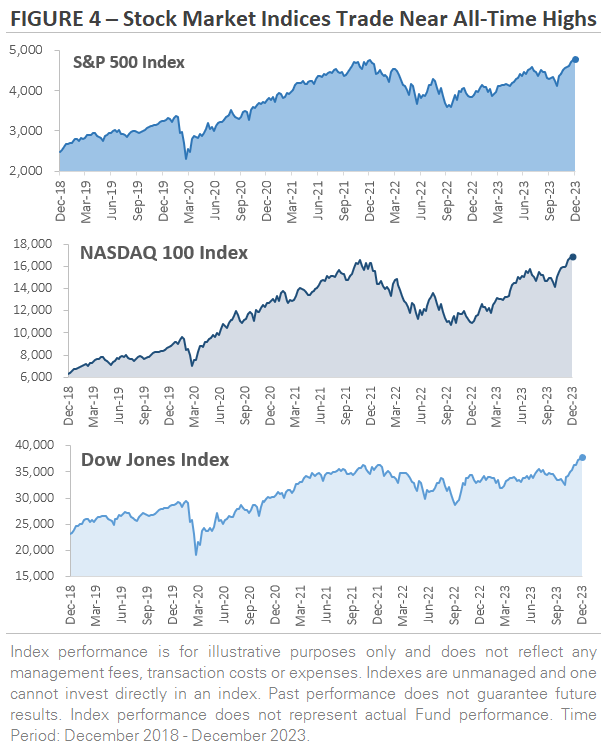

Falling interest rates were a tailwind for stocks in the fourth quarter. Key stock market indices like the S&P 500, the Dow Jones, the NASDAQ 100, and the Russell 2000 each returned more than +11%.

Real estate was the top-performing sector as falling interest rates relieved pressure on property owners, and cyclical sectors outperformed defensive sectors.

In December, the Russell 2000 Index of small cap stocks outperformed the S&P 500 by +7.6%, its biggest month of outperformance since February 2000.

The broad-based stock market rally demonstrates investors’ growing enthusiasm, with inflation falling, the economy surpassing expectations, and the Fed signaling the end of rate hikes.

What does the financial landscape look like today? Following the Q4 rally, multiple major stock market indices are trading near all-time highs.

Figure 4 on the next page graphs the prices of three broad stock market indices: the S&P 500, the NASDAQ 100, and the Dow Jones. The S&P 500 is hovering near its January 2022 all-time high, while the NASDAQ 100 and Dow Jones both made new all-time highs in December.

On a year-to-date basis, the S&P 500 returned +26% in 2023, and the Russell 2000 returned +16.7%. The NASDAQ 100 soared +54.7%, its biggest year since 1999.

Along the way, stocks defied higher interest rates, geopolitical tensions, and multiple U.S. regional bank failures to record solid gains.

Stock Markets At All Time Highs

Stocks defied higher rates, geopolitical tensions, and US bank failures to record solid gains.

Bond Trends During the 3rd Quarter

Bonds traded higher in Q4 as Treasury yields reversed their Q3 rise. The Bloomberg U.S. Bond Aggregate, which tracks a broad index of U.S. investment-grade rated bonds, produced a total return of +6.7%.

It marked the first quarterly gain since Q1 2023 and the biggest quarterly gain since Q2 1989.

This shift in investor sentiment toward bonds can be attributed to several factors, including two themes we’ve already discussed. Inflation is falling, and the Federal Reserve is expected to start cutting interest rates.

After weathering an extended period of negative returns as the Federal Reserve raised interest rates, bonds are now experiencing a resurgence in popularity.

Investors have been trying to time the top in Treasury yields, and as sentiment improved and rates declined in Q4, investors rushed to lock in yields. It’s a dynamic that’s played out in recent quarters, which has contributed to the increased bond market volatility.

The question is whether investors have accurately picked the peak in yields. The answer will be determined by the trajectory of inflation and the Fed’s interest rate cuts.

Outlook Going Forward

Heading into the new year, the economy is growing at a solid pace, the labor market is tight, inflation is decelerating, and the housing market shows early signs of a rebound.

Economic data indicates that higher interest rates have yet to make a significant impact. Stocks trade near all-time highs, and bonds just staged their best quarter since 1989.

There is a growing sense of optimism, but can the economy live up to that optimism?

Multiple themes suggest the U.S. economy experienced a structural shift during the pandemic. Cross country migration during the pandemic is driving increased government investment today as states and local municipalities expand and build infrastructure to meet increased demand and usage.

This translates into new schools, more expansive road networks, new neighborhoods, and airport expansions. In addition, there is still a housing shortage after the U.S. underbuilt following the 2008 financial crisis.

Remote work is a new phenomenon, but it doesn't appear to be going away anytime soon. Fridays and Mondays are no longer constraints on taking a weekend trip, which could lead to more spending on services and experiences.

It takes time for higher interest rates to work their way into the economy, and the economy could slow in 2024. However, these structural changes demonstrate how today’s economy differs from the pre-pandemic economy.

Looking ahead at the calendar, the 2024 presidential election will grab headlines for most of the year, with the first primary elections taking place in January.

It will be a busy time as candidates discuss their platforms. There will be a lot of talk about new policies and big changes, but it’s important to keep the bigger picture in mind.

Election headlines tend to be more noise than anything of substance. Elections create uncertainty and volatility, but history shows us that economic growth and corporate earnings ultimately drive markets over the long term.

Our focus in 2024 will be on the growing list of non-political themes, such as interest rate cuts and the post-pandemic changes impacting the economy.