We Help The Personal Side Of your Business.

Maximize Your Corporate Structure and Retirement Plans

Run Your Business The Way It Should Be.

We Specialize in Family Owned S-Corporations, LLC’s, and Sole Proprietors

Corporate Formation

Understand when to incorporate, the benefits of an S-Corp. or LLC, and how to align your tax strategy.

Retirement Plans

Learn the various retirement plans available to sole owners as well as employees.

Coordinated Strategy

Your business is an extension of you. Coordinate a game plan to align your business and personal goals.

Go Beyond a Traditional 401k.

Utilize Retirement Plans Designed Specifically For Business Owners

Business Retirement Plans

While a traditional 401k may be the right fit, there are numerous additional options that can increase your contribution levels.

What “Pass Through Entities” Actually Mean.

Understand How Self Employment Works

Pass-Through Income

Your business structure may provide liability protection, however all income may “passed through” to you. Understand what this means and strategies to implement.

We Work Closely With Your Existing Team.

We Work Together With Your Team Members

Team Approach

We partner with CPA’s, Attorney’s, and other professionals to create your business team.

Align Your Business & Personal Goals Into One Plan.

See How Company Profits or Exit Opportunities Enhance Your Financial Plan

Coordinated Plan

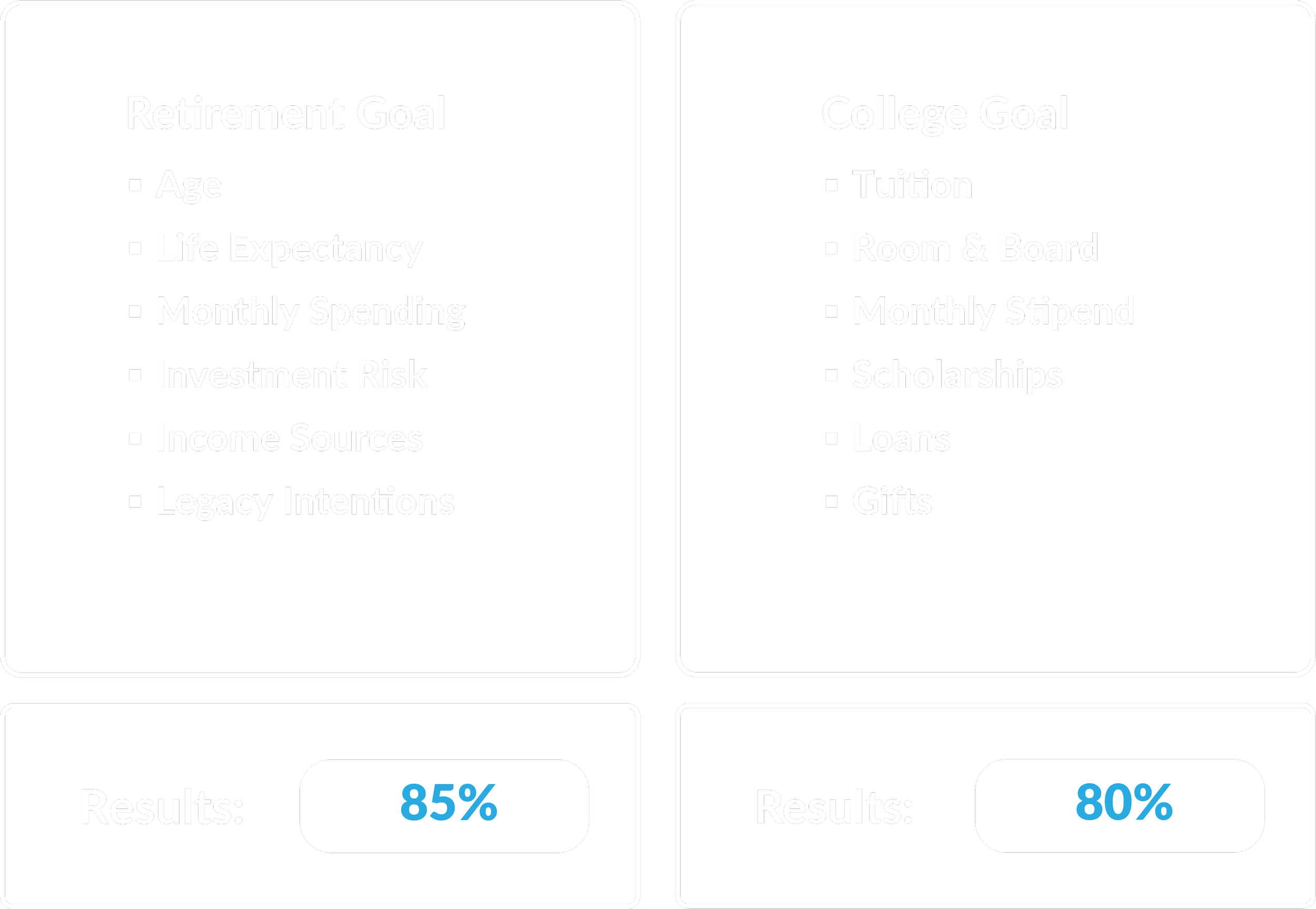

Your business success has limitless potential. See how future income or sale proceeds affect your personal goals.

The Cliff Notes On How We Help.

Here Are The Most Common Questions We Get

You wear many hats and time is precious. Take a quick glance on what other business owners want to know.

-

No. We leave the idea of the business you want to create, price point, etc. up to you. Once your business is established we help with the financial planning of your existing revenue and expenses.

-

Yes! We help many solo busines owners create and maintain their retirement plans. We work with a network of TPA’s and CPA’s to help with compliance.

-

Yes! We help with the investment management of cash balance plans. However, we do not draft the actual plan. Instead we use a network of TPA’s and actuaries to handle the administrative tasks (for a separate fee).

-

Yes! We create and handle the investment management if the accounts are held at Charles Schwab.

-

For solo business owners who are incorporated as an S-Corp we can help with payroll. We do not offer bookkeeping services.

-

Yes! We have many clients who utilize LLC’s as their company structure.

-

No! We provide both personal and business financial advice for one flat fee.

Get Started Today

Schedule Your Introduction Meeting

Discuss your business with us and see if we can help.