Flat Fee Investing

Learn More About Our Strategy and Philosophy

Quick Read

We follow a Core and Satellite investment strategy

The Core position invests for the long term while the satellites invest for short term opportunities

We invest based on academic research and economic leading indicators

Our flat fee investing approach does not increase as your balance grows

One Strategy, Three Parts

Our investment strategy has one objective: invest intelligently.

While we cannot promise how your investment account will perform, we can help guide your portfolio with research as our foundation and economic indicators as our guide.

Intelligent investing for us comprises three areas: strategy, research, and fees.

Our strategy is rooted in the core and satellite approach. The core position is designed to capture market returns such as the S&P 500.

The satellite positions are designed to either boost returns or minimize volatility.

We use both historical data and economic indicators to establish our research foundation. We use our findings to guide investment allocation decisions.

Additionally,y our flat fee investing approach helps maximize returns by keeping fees level as your account balance increases.

Part #1: Investment Strategy

We align with the long-term investment philosophy that the stock market is hard to beat. A simple investment in a market index such as the S&P 500 has built significant wealth for patient investors.

So we go with the flow. The core position is built around capturing the general stock market returns represented by a S&P 500 index fund or similar ETF (exchange-traded fund).

The core position starts out around two-thirds of your portfolio and can incorporate bonds depending on your level of risk.

S&P 500

Core Position

The core position is designed to capture stock market index returns such as the S&P 500.

The core position is rooted in the philosophy that stock markets are efficient over long periods of time. Instead of focusing on how to beat the market, we focus on simply capturing as much market return as possible with the lowest tax and fee headwinds.

The core position is designed for the long term and can be held for decades at a time.

However, there are periods of time in the short term, defined as 1 - 5 years, where markets can be inefficient. We try and capitalize on these inefficiencies using satellites.

Satellites are specific sector or industry positions, usually 5% to 10% of the overall portfolio, designed to either boost returns or provide more downside protection.

10%:

Real Estate

60%: S&P 500

10%:

Start Ups

10%:

Technology

10%:

Healthcare

Satellite Positions

Satellite positions invest in specific sectors to take advantage of short term opportunities.

There are numerous satellites we can utilize. It can be individual stocks, real estate, private equity, or even collectibles. The philosophy is to invest in areas that traditionally perform differently than the core position or general market.

That said, satellite positions can be risky. It is a concentrated position with a lack of diversification. To mitigate the risk, we keep the allocation small at 5% to 10% of the portfolio.

Combined together, the core position is the tried and true passive approach. Set it and forget it to an extent. The satellites are tactical in nature, shifting based on real-time research and expectations.

Part #2: Research

Why do we take the time to implement the core and satellite strategy? We believe it moves the dial.

There is plenty of research available on why investing in a low cost, long term index or ETF such as the S&P 500 makes sense. We’ll focus on why incorporating satellites is important.

One foundational element to explaining satellites is understanding volatility. If we are trying to achieve returns that are different than the general stock market, we need investments to perform, well, differently.

For example, if the stock market goes up 10%, we may expect a satellite position to be up 15%. Investing in specific sectors or industries has a wider spectrum of upside and, unfortunately, downside. We call that volatility.

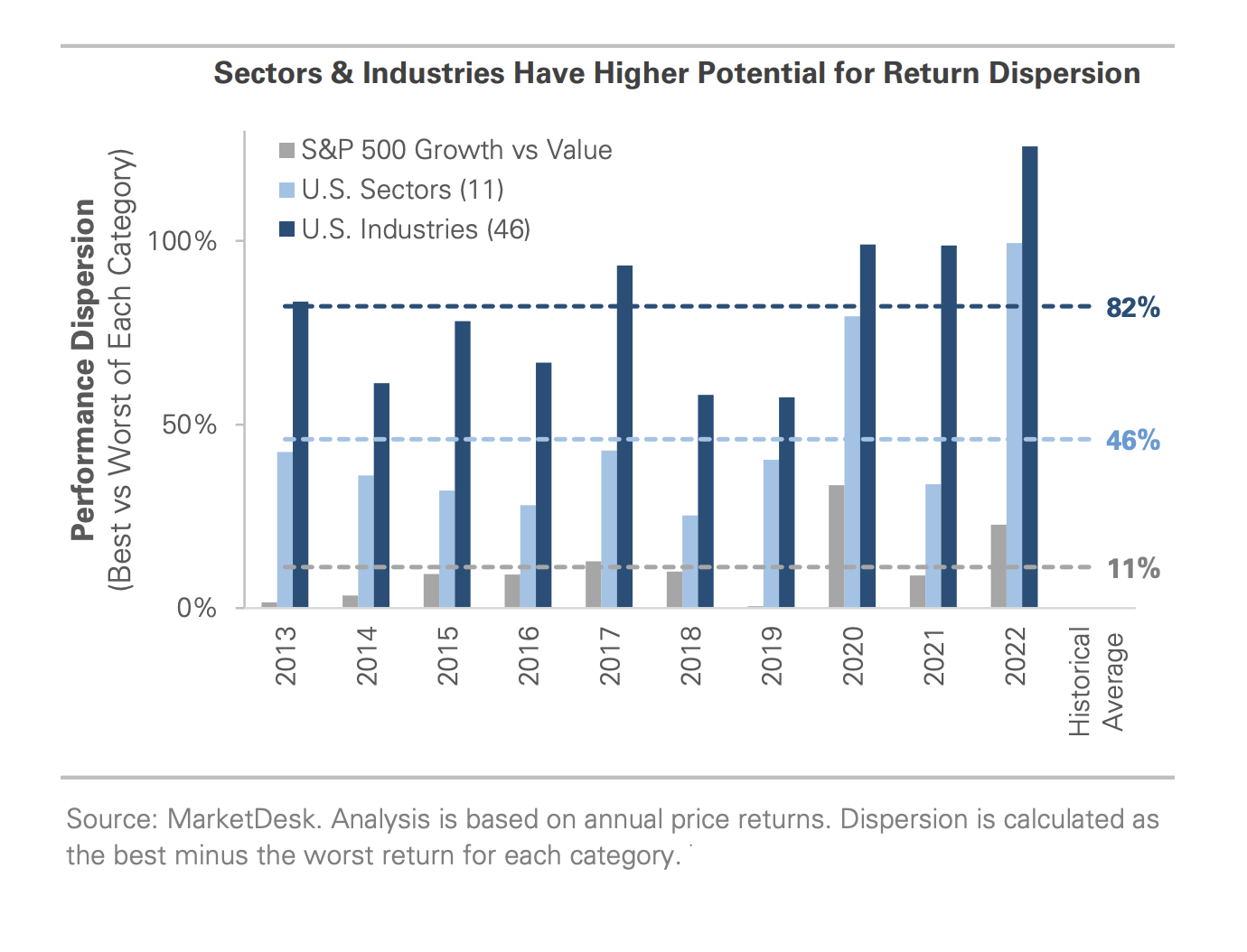

The graph below measures the difference in returns between S&P 500 growth and value styles and individual sectors or industries.

Sector Volatility

The bars indicate the difference between the best and worse performance for the S&P 500 growth and value styles and sectors/industries. A larger difference is noticeable in sectors, providing upside opportunity.

The graph illustrates the importance of investing in sectors and industries. By concentrating on sectors you have pure exposure to factors such as economic sensitivity and fundamental drivers which can cause short term swings in performance.

Owning the right sectors that have indications to be directionally correct and avoiding those not suited for the current economic regime provides an opportunity for outperformance.

Full disclosure, finding the right sector at the right time is more art than science. To say we get it right every time is unrealistic. But we are cautious to make changes and fast to make corrections as needed.

We research each sector using a repeatable and systematic process. The financial markets are full of headline noise. Our job is to combine our research with leading economic indicators to identify the most attractive industries.

Evidence-Based Research

On top of the research we do for sector positions, we use a collection of economic indicators and risk management tools to simplify our investment decisions.

Our research tools focus on data-driven signals. We rely less on expert opinions and prefer to use statistical probabilities, historical data sets, and leading indicators to guide our strategy.

In other words, we reward facts vs. opinions.

Our research focuses on four key areas:

U.S. Equities

S& 500 EarningsPrice Target

U.S. Economics

Business Cycle/GDPHome PriceUnemployment

U.S. Credit

Lending StandardsNet LiquidityFinancial Conditions

Tactical Tools

Investor SentimentRisk DemandBear Market Risk

Part #3: Flat Fee Investing

As great as an investment strategy may be, traditionally any benefits to the investor can be eaten away with significant fees.

We change that. Our flat fee investing approach is not based on how much money you have or make. It is simply based on the complexity of your situation.

Your flat fee is incorporated with your financial planning fee to create one flat monthly or quarterly fee.

Compared to percentage fees, flat fee investing is a simple approach to boost your returns without having to take more risk.

Flat Fee vs. Percentage Fee

A flat fee keeps more of your investment gains in your account by not rising as your balance increases.

While our fees are flat, our investment management is anything but basic.

Your investing flat fee covers the same industry standard approach to managing investments:

Tax loss harvesting

Rebalancing

Performance reporting

Client portal

Alternative investments (if you qualify)

While our flat fee investing approach may be different, our ability to manage your investments is similar to industry standards.

See Our Pricing

Flat Fee Investing

Your investment fee is combined with your financial planning fee to create one simple fee. Check out our pricing below.